Silver is Vastly Overvalued, But Retail Demand Could Lift it to $170

Historically, silver prices have been explained by the U.S. dollar, global industrial production, and ETF inflows. Widmer said that if retail investors continue to increase exposure at the same pace seen in the third quarter of 2025, silver could extend much further.

“We can justify silver rallying to $170/oz in the next two years if retail investors keep increasing their exposure at the same pace,” he wrote, while stressing that this scenario is “a tall order and not necessarily our base case.”

"This underscores the powerful impact of retail flows on the market," he added.

Beyond price momentum, Bank of America highlighted silver’s renewed role as a hedge against broader monetary concerns. Persistent anxiety around fiat currencies, the rise of crypto and stablecoins, and potential disruptions to traditional banking systems are reinforcing "silver’s appeal as a tangible, non-digital store of value remains strong for retail investors," Widmer concluded.

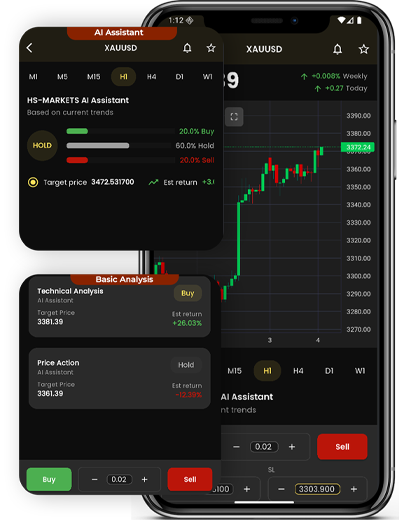

© 2025 Hoangson Markets Limited | Hoangson Market Limited confirms that it owns and operates the domain https://hs-markets.com .