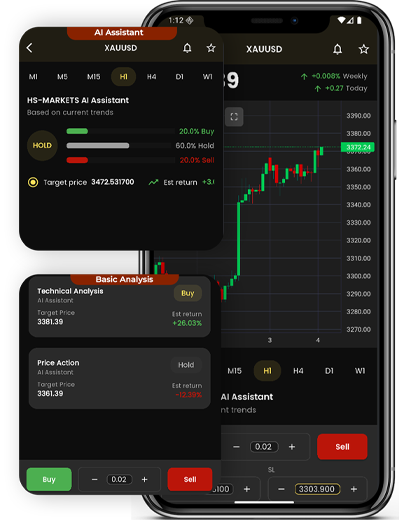

Market Report: Gold Reclaims $5,000 Amid Geopolitical Heat and Fed Reshuffle

Date: February 4, 2026

Market Status: Bullish Recovery

Spot Gold (XAU/USD): ~$5,078.00 (+2.66%)

Executive Summary

Gold prices have staged a dramatic comeback, surging back above the psychological $5,000 per ounce threshold. Following a historic "flash crash" late last week that saw prices plunge nearly 10% to $4,400, the yellow metal has regained approximately half of its losses. The recovery is fueled by a "perfect storm" of geopolitical escalation in the Middle East, a hawkish shift at the Federal Reserve, and aggressive dip-buying from institutional "smart money."

Key Market Drivers

1. Geopolitical Safe-Haven Demand

The primary catalyst for today’s rally is the sudden escalation in the Arabian Sea. Reports that US forces downed an Iranian drone near a carrier strike group have reignited fears of a broader regional conflict. While the White House has signaled that diplomacy remains the priority—with high-stakes talks still scheduled for Friday—investors have reflexively pivoted back to gold as a primary hedge against geopolitical tail risk.

2. The "Warsh Effect" & Federal Reserve Independence

The financial landscape was jolted earlier this week by President Trump’s nomination of Kevin Warsh as the next Federal Reserve Chair.

-

Hawkish Outlook: Warsh is viewed by markets as significantly more hawkish than his predecessors, leading to expectations of a tighter balance-sheet policy.

-

Independence Concerns: Ongoing investigations into current Chair Jerome Powell have raised questions regarding the central bank's autonomy, prompting a rotation out of US dollar-denominated assets and into hard commodities.

3. Technical Resilience and "Smart Money" Accumulation

Technical analysts note that the recent sell-off found "perfect support" at the 50-day exponential moving average (EMA) near $4,550.

"The violent swing from a $5,608 high to a $4,400 low in just hours—and the subsequent 6.9% rally on Tuesday—demonstrates that the structural bull market is far from over," noted a lead strategist at JPMorgan.

Financial Outlook & Institutional Forecasts

Despite the extreme volatility, major investment banks have revised their year-end targets upward, citing a "fundamental system shift" in global reserves.

Global Market Ripple Effects

-

Silver: The "grey metal" has followed gold's lead, rebounding to approximately $89.50 per ounce. Analysts at BMO suggest the gold-silver ratio may compress further as silver's industrial role in the green energy transition aligns with its monetary safe-haven status.

-

Equities: While gold glitters, mining equities have shown relative weakness compared to the physical metal, suggesting a potential "catch-up" trade or further consolidation in the sector.

© 2025 Hoangson Markets Limited | Hoangson Market Limited confirms that it owns and operates the domain https://hs-markets.com .